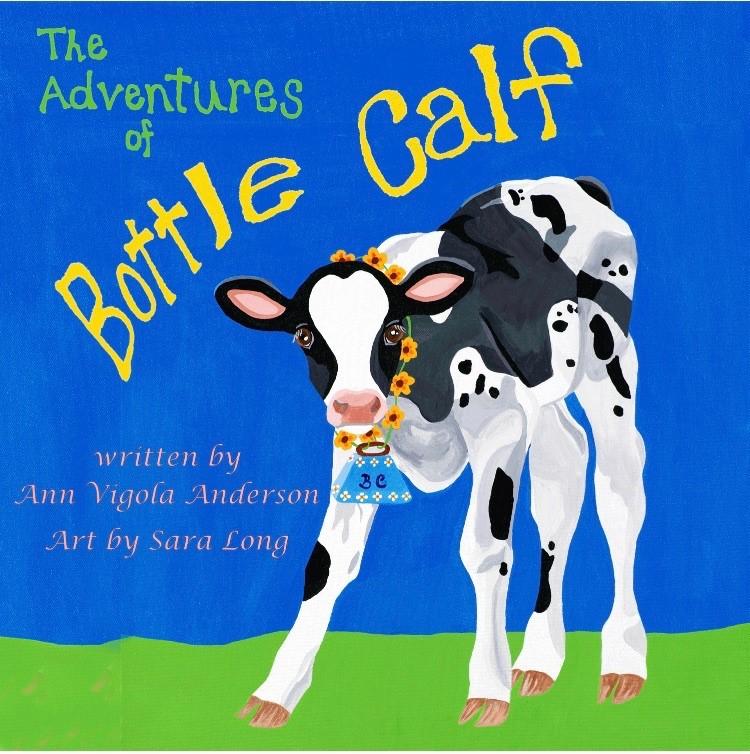

Cultural Corner to host colorful exhibit featuring Liberty artist

Cultural Corner Art Guild and Gallery is pleased to exhibit the work of Liberty artist, Sara Long.

Cultural Corner Art Guild and Gallery is pleased to exhibit the work of Liberty artist, Sara Long.

Columbia College recently announced its dean’s list for the Fall 2023 Semester (August-December 2023).

State Budget Director Dan Haug announced today that net general revenue collections for December 2023 grew 0.6 percent compared to those for December 2022, from $1.08 billion last year to $1.09 billion this year.Net general revenue collections for 2024 fiscal year-to-date decreased 1.7 percent compared to December 2022, from $6.24 billion last year to $6.13 billion this year.GROSS COLLECTIONS BY TAX TYPEIndividual income tax collectionsDecreased 22.7 percent for the year, from $4.34 billion last year to $3.36 billion this year.Decreased 50.5 percent for the month.Pass-Through Entity tax collectionsIncreased from $0 to $648.9 million this year.Sales and use tax collectionsIncreased 10.5 percent for the year, from $1.50 billion last year to $1.65 billion this year.Decreased 1.4 percent for the month.Corporate income tax collectionsIncreased 2.4 percent for the year, from $483.9 million last year to $495.4 million this year.Decreased 2.6 percent for the month.All other collectionsIncreased 28.4 percent for the year, from $338.2 million last year to $434.3 million this year.Increased 110.7 percent for the month.RefundsIncreased 8.6 percent for the year, from $419.9 million last year to $455.8 million this year.Increased 12.4 percent for the month.Pass-Through Entity tax collections were previously reported within Individual Income, which makes growth in Individual Income tax collections appear artificially low.The figures included in the monthly general revenue report represent a snapshot in time and can vary widely based on a multitude of factors.

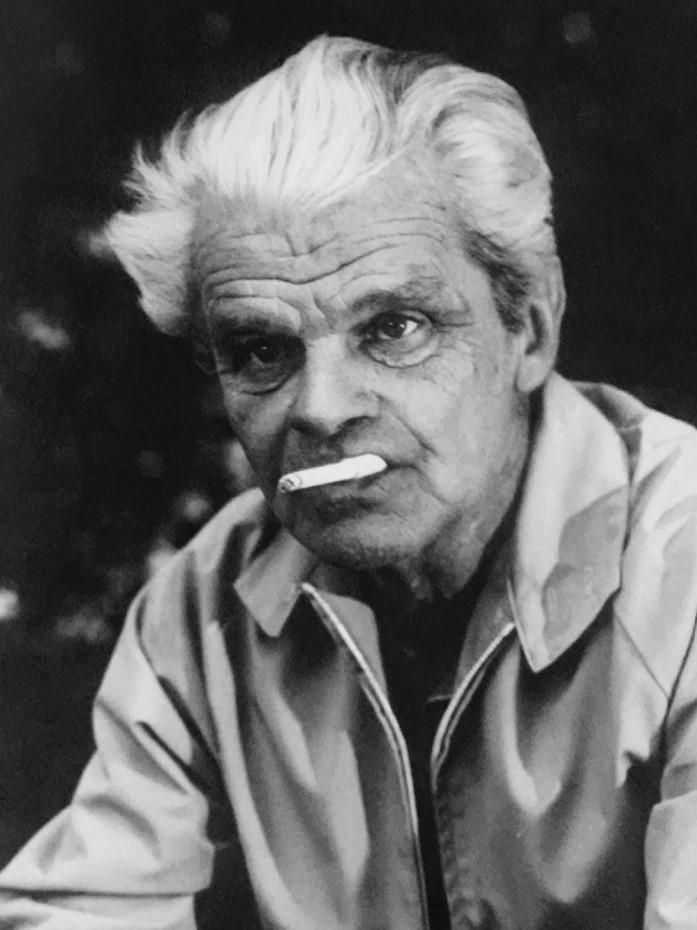

Missouri native, Eustace Cockrell, is finally getting recognition as a significant writer whose works spanned the transition from the pulp fiction magazines of the 1930s to television’s Golden Age of the 1950s.Cockrell was born in Warrensburg in 1909.

People who live in rural communities live an average of three years fewer than urban counterparts and have a 40% higher likelihood of developing heart disease.

Wreaths Across America is an annual tradition honoring the courage and sacrifices of our nation’s military heroes.

The Smithsonian moving museum exhibit, Crossroads: Change in Rural America, will be up for display at the Brookfield License Office from February 4-March 17.The community is fortunate to have the Tillman House Museum open for specially with the event.

Great Northwest Day at the Capitol (GNW) allows constituents of the 19-county Northwest Missouri region a more direct and effective voice in Jefferson City.

MFA Oil Company, a farmer-owned energy supply cooperative, has good tidings to share with its members this holiday season.

The Wheeling Happy Harvesters 4-H Club met on December 16, 2023, for their regular monthly meeting which included a pizza party and a community service project.